[ad_1]

[ad_1]

For years, Meghan Neri paid $30 apiece for packages of epinephrine auto-injectors for her two adolescent kids with meals allergy symptoms. The value for 4 packs of the lifesaving remedy was a manageable $120 a 12 months.

So Neri, 42, of Scituate, Massachusetts, was shocked when, in 2019, her household pharmacist stated that every auto-injector pack would price $600.

Her out-of-pocket price for the 12 months had skyrocketed to $2,400.

The value of the epinephrine photographs themselves had not risen. The issue was the Neris had switched to a brand new, high-deductible medical health insurance plan to economize. Month-to-month funds are decrease with high-deductible packages, however households should pay 1000's of dollars annually earlier than many prices — typically together with epi auto-injectors — are lined.

Just like the Neris, many households are caught off guard by the leap in worth. Some are pressured to ration the auto-injectors or go with out them.

“Many households have opted to not decide up their EpiPens as a result of they will’t afford it,” stated Dr. Purvi Parikh, an allergist and immunologist at NYU Langone Well being in New York Metropolis. “They’re taking the prospect that, God forbid, a nasty consequence will happen.”

Parikh stated households have needed to shoulder increasingly monetary tasks over the previous decade, notably as high-deductible insurance coverage have grow to be extra widespread.

The 2010 Reasonably priced Care Act expanded entry to medical health insurance, so corporations have been confronted with protecting extra individuals than ever earlier than. To compensate, insurers “not solely raised how a lot it prices to be lined, however they’ve pushed extra of that out onto the affected person within the type of high-deductible plans,” Parikh stated. “We’ve been seeing this each single 12 months for at the least the final seven to 10 years.”

An evaluation by KFF, often known as the Kaiser Household Basis, discovered that in 2009, 17% of staff have been enrolled in a well being plan with an annual deductible of at the least $1,000. By 2021, it was 50%.

“The typical deductible in employer-based medical health insurance now could be over $1,700 per individual,” stated Larry Levitt, govt vice chairman of KFF.

With some household plans, deductibles can soar effectively over $3,000.

“What it means is that even whenever you’re insured, chances are you'll not really be shielded from probably catastrophic well being care prices,” Levitt stated.

Prescriptions that beforehand price not more than $30 or so — a primary copay — at the moment are full worth, which may soar into tons of of dollars.

Some medicines, reminiscent of medicine to manage hypertension, are lined even earlier than the deductible is met. However the epinephrine auto-injectors — which ship a shot of epinephrine and are the one emergency medication out there for life-threatening allergic reactions — normally aren't.

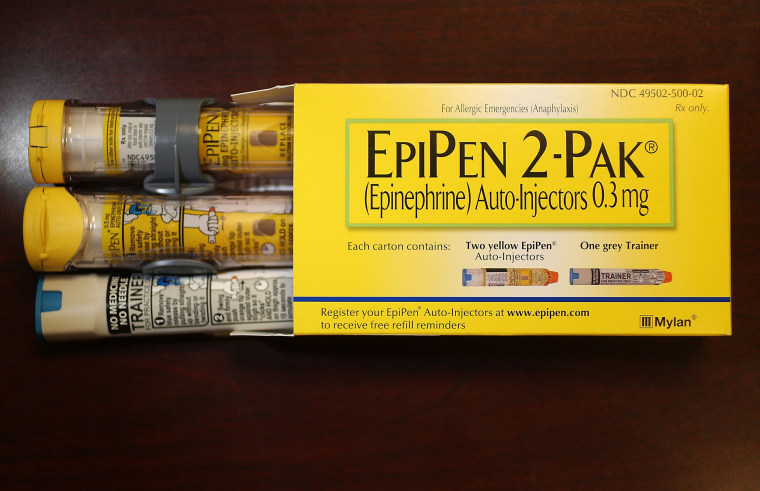

Few pharmaceuticals or gadgets symbolize out-of-control well being care prices greater than EpiPen.

From 2008 to 2016, Mylan pharmaceutical firm raised the value of its auto-injectors by greater than 400%, resulting in public outrage and congressional scrutiny.

Different epinephrine-delivering merchandise quickly emerged, reminiscent of Adrenaclick and Auvi-Q, together with generics, with the hope of making costs extra individuals might afford. It labored, to some extent.

“The quantity that privately insured sufferers needed to pay out of pocket did lower,” stated Dr. Kao-Ping Chua, an assistant professor of pediatrics on the College of Michigan Medical College and the Susan B. Meister Youngster Well being Analysis and Analysis Middle in Ann Arbor, Michigan.

Negative effects: Extra on drug prices within the U.S.

However after switching to a high-deductible plan, some sufferers just like the Neris found they have been charged practically full worth for epinephrine auto-injectors.

Neri’s daughter, Shea, 14, has a milk allergy, and her son, Thomas, 12, is allergic to take advantage of, peanuts and tree nuts. They don't go away dwelling with out the gadgets nestled right into a small fanny pack they put on always — simply in case of an publicity.

“You hope that it’s wasted medication and wasted vitality,” Neri stated.

The injectors are solely good for one 12 months, on common. The Neri household should buy 4 auto-injector packs for the 2 kids annually to maintain of their dwelling and faculties. Shea and Thomas have every had to make use of the emergency epinephrine photographs.

When the pharmacist advised Neri the brand new worth for the refills, she was devastated and didn't pay the $2,400 that day.

“It was a little bit embarrassing to say, ‘I can’t do that proper now,’” she stated.

Deductibles are supposed to discourage improper use of medical care and abuse of pharmaceuticals, Levitt stated. However epinephrine auto-injectors save individuals’s lives.

“Nobody is utilizing them inappropriately,” he stated.

Certainly, Neri stated the auto-injectors are mandatory instruments to guard her kids.

Folks don’t count on to pay this a lot once they have medical health insurance.

Pediatrician Dr. Kao-Ping Chua, College of Michigan Medical College

“This isn't a selection. Nothing about it is a selection,” she stated.

Epinephrine is the primary line of protection when an individual has a extreme allergic response, referred to as anaphylaxis. When this happens, blood stress plummets. Airways slim, making it arduous to breathe. A shot of epinephrine, or adrenaline, can reverse what might in any other case be lethal.

“For top-value, lifesaving medicines, there ought to be zero price out of pocket,” stated Chua, of the College of Michigan.

Chua has spent years finding out how a lot households pay for emergency epinephrine. He led a examine revealed in July that discovered 1 in 13 sufferers have been paying greater than $200 a 12 months for his or her epinephrine auto-injectors.

Most have been kids, partly as a result of allergy symptoms are extra prevalent in children than adults, but in addition as a result of they want a number of auto-injectors to retailer at dwelling, in school and through after-school actions.

A majority of the households paying greater than $200 a 12 months in Chua’s examine — 62.5% — have been enrolled in high-deductible well being plans.

“I view this primarily as an issue of insurance coverage profit design,” Chua stated. “Folks don’t count on to pay this a lot once they have medical health insurance as a result of they assume that insurance coverage will cowl the remedy.”

Sufferers can query excessive costs

“It’s usually as much as insurers — and employers within the case of office well being advantages — whether or not any well being care companies and medicines are exempt from the deductible,” Levitt stated.

Medical health insurance corporations might exempt epinephrine auto-injectors from their excessive deductibles. UnitedHealthcare introduced that beginning subsequent 12 months, there will probably be no copay or different out-of-pocket prices for epinephrine on a few of its plans.

It’s the one main medical health insurance firm to cowl epinephrine to this point, however “we're more and more seeing a pattern in direction of insurance coverage corporations waiving out-of-pocket prices for sufferers for medicine which might be lifesaving,” Levitt stated.

Chua stated it could be good public coverage to restrict the price of different lifesaving medicine, too, reminiscent of insulin for diabetes and naloxone to reverse opioid overdoses.

However AHIP (previously generally known as America’s Well being Insurance coverage Plans), a gaggle that represents such corporations, stated drug producers are responsible.

“We encourage Huge Pharma to finish their worth gouging techniques and decrease their out-of-control costs for sufferers,” the group stated in an announcement to NBC Information. “Sufferers want their life-saving medicines, so a scarcity of remedy decisions imply that Huge Pharma has no incentive to comply with decrease costs.”

Finally, navigating well being plans and scrambling to determine methods of paying for costly medicines is left to sufferers.

“An important factor to know is whether or not or not they need to pay a deductible for medicine earlier than insurance coverage protection happens,” Chua stated.

After that day within the pharmacy, Neri took an in depth have a look at her household’s medical health insurance plan and contacted their doctor to speak by way of different choices.

They switched to a unique model of emergency epinephrine and now pay $25 per pack.

“We have been going to spend what we wanted to maintain them protected,” Neri stated. “But it surely’s useful to have sufficient info to make an informed resolution and never really feel such as you’re throwing cash away unnecessarily.”

Levitt stated that sufferers ought to really feel empowered to query excessive costs.

“It’s a number of work,” Levitt stated, however “in the event you’re confronted with a claims denial, in the event you’re confronted with a excessive price, battle it. Battle it together with your well being care supplier, battle it together with your insurance coverage firm.”

“No nearly by no means means no in medical health insurance,” he stated. “You'll be able to typically win.”

Comply with NBC HEALTH on Twitter & Fb.

[ad_2]

Supply hyperlink https://classifiedsmarketing.com/?p=21553&feed_id=79536